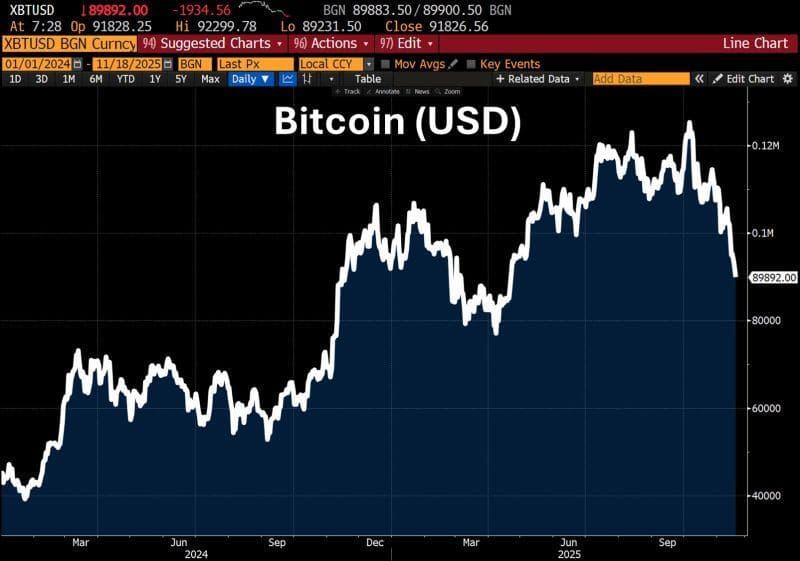

Yikes! Bitcoin has dropped below USD 90K, down nearly 30% from its peak. What does it mean? I don't really know!

Yikes! Bitcoin has dropped below USD 90K, down nearly 30% from its peak. What does it mean? I don't really know!

Yikes! Bitcoin has dropped below USD 90K, down nearly 30% from its peak. What does it mean? I don't really know!

A lot of people do seem to know exactly what is going on. Early whales selling, Federal Reserve uncertainty about future rate cuts, loss of economic momentum, and liquidity issues.

Probably all of the above affect the price of bitcoin. Perhaps the absence of major news items that serve as catalysts for price increases should be added to the list.

Every time bitcoin dives, the clash between bitcoin nonbelievers and enthusiasts stirs up. The first group forecasting, for the millionth time, the end of bitcoin, having missed

unprecedented upward potential, while the second group gets more innovative each cycle. They are coming up with fancy reasons why this is yet another great time to buy, often accompanied

by fresh money created out of thin air to invest more.

The truth is, a bitcoin price decline of 30% tells you very little. With realized volatility still four times that of equities, these drops are part of the investment journey.

By the way, things are no different from investing in equities. Back in March and April (social) media and market pundits were also calling the end of the great post-pandemic bull market, while others kept screaming to 'buy the dip.'

If you see in bitcoin a reliable store of value offering a hedge against fiscal dominance, in which monetary policy is pushed aside by fiscal policy, resulting in ultra-low interest rates, high inflation, and waves

of liquidity, then this may offer an opportunity.

If you believe this time is different and that we are witnessing the final collapse of bitcoin, then sit back, relax, and invest elsewhere.

What is your take on bitcoin's recent price action?